#TQQQ #QQQ

아주 좋은 내용이다. 그러니까, 거의 Basic 기초 수준: https://seekingalpha.com/article/4428089-the-tech-bubble-is-not-in-qqq-etf?mail_subject=must-read-intel-the-empire-strikes-back&utm_campaign=nl-must-read&utm_content=link-3&utm_medium=email&utm_source=seeking_alpha

이미지 썸네일 삭제

The Tech Bubble Is Not In QQQ (NASDAQ:QQQ)

Despite the rotation to cyclical and value plays, the secular growth themes for the leaders in the Invesco QQQ ETF remains well intact.

seekingalpha.com

1. 구성

2. 가격:

3. 전략

- 2001년 부터 2021년 5월 11일까지, buy&Hold 전략시 711%, TQQQ는 아마도 2300% 정도?

이 외에 다양한 테스팅이 있는데, 내 눈에는 다 말짱 '황' 으로 보임. ㅋ

4. 결론 (은 직접 번역하세옄)

Conclusion

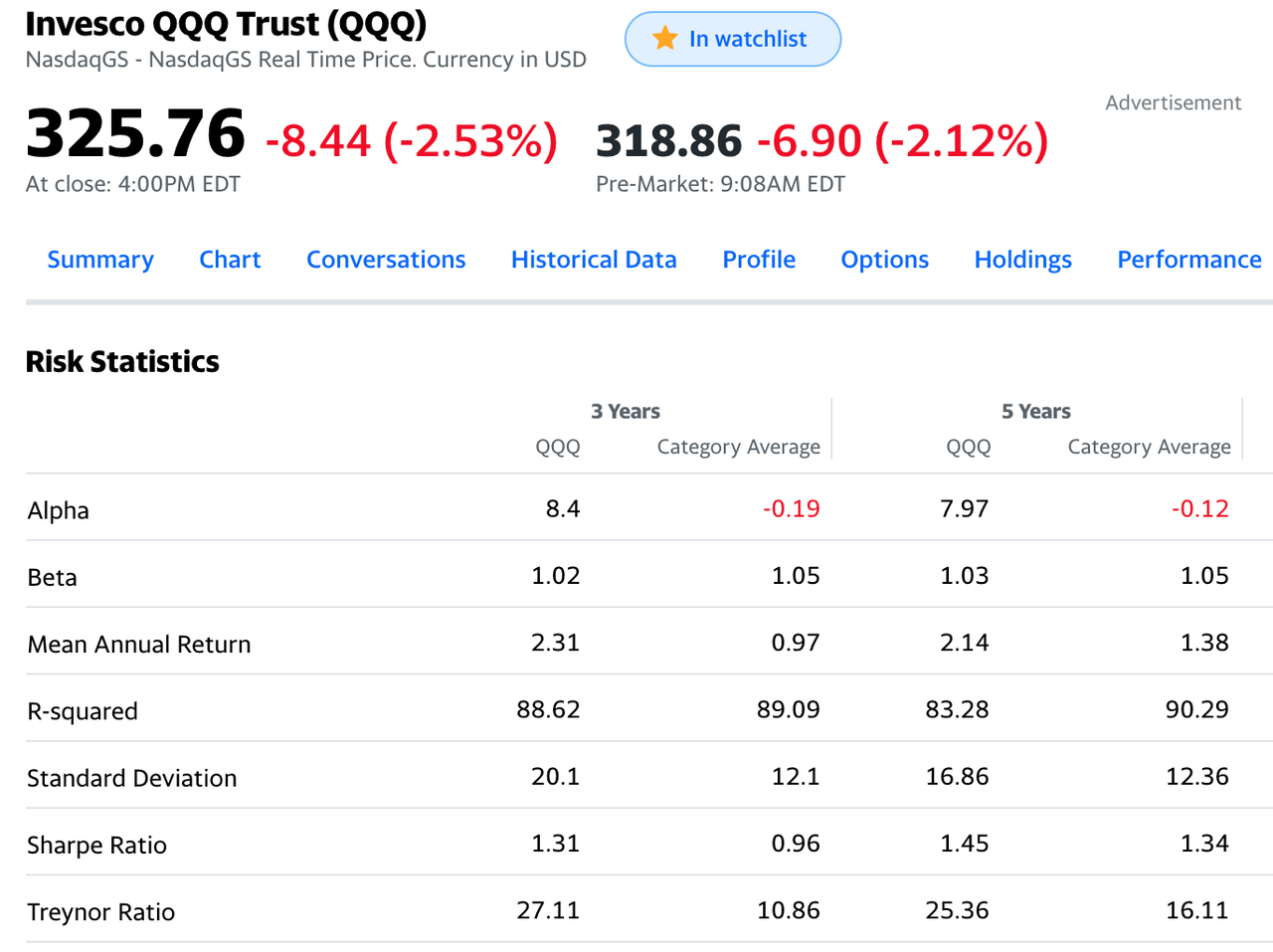

QQQ offers investors access to a diversified portfolio of high quality secular growth stocks with a Tech focus. Its superior long term Sharpe ratios should give investors confidence of its long run growth potential, and a worthy consideration for any growth-oriented investors’ portfolio.

그리고 댓글 중 하나: (뽐뿌?)

Po**** F***

Today, 4:37 P|

Dear Reader..

I am totally in disagreement with the conclusions reached in this article. This article does accurately replicate what is taught in the academic community.

In the real world, the more valuation levels for financial assets rise the larger the risk becomes. You can take any financial asset and spreadsheet it with the periods of the highest 3 or 5 year returns. In the next column, put what the subsequent 3 year or any other period of future returns were.

I have been commenting on Seeking Alpha since 2009. All of my comments still exist. In December, 1972 we had the "nifty fifty." These were fifty stocks the academics assured us that we could pay any valuation for because their future was so bright. They were wrong.

The QQQ is trading at 35x p/e, 21x cash flow and 8x book value. It's a nice business for the insiders and the venture capital industry. What happens to the long term investor? We have seen these spreads in p/e ratio before and it was a disaster for the investor.

You are only hearing about the core CPI (without food and energy) at 3%. The CPIAUCNS (urban consumer) is at 4.2%. The PPI is up 12.4%. I don't remember these last numbers being reported on Bloomberg TV. The true real yield is deeply negative. That has not been always bullish in the past.

We are in a speculative bubble. You not only have the Nasdaq, but also the cryptocurrencies, the SPAC's and the IPO market.

I hold no U.S. equities. S&P 4112, Nasdaq 13124, GBTC 37.18, SPAK 22.35

If you would like to know what I hold just scroll back to my previous comments.

끝.

- 결론; TQQQ 투자 하지 마세요.

- GJH 말 믿지 마세요.

'투자 노크 > 투자 생각' 카테고리의 다른 글

| 투자의 함정을 대하는 자세, 24/05/2021 (0) | 2021.05.24 |

|---|---|

| [테슬라] TSLA 신나게 까인다 (0) | 2021.05.24 |

| [TQQQ] 나스닥 100 3배 레버리지는 이거에 강함. (0) | 2021.05.19 |

| [인플레이션] 주식시장, 무조건 하락한다? (0) | 2021.05.19 |

| [배당 축소]는 이것으로 이어진다 (0) | 2021.05.17 |